accumulated earnings tax calculation example

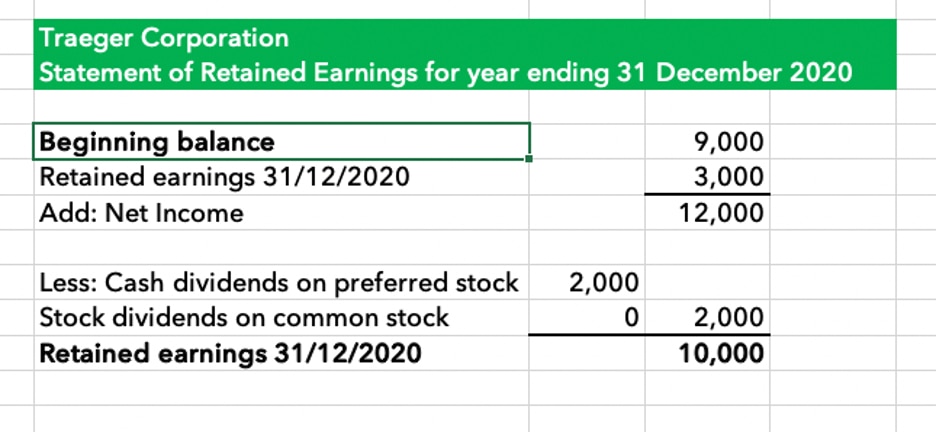

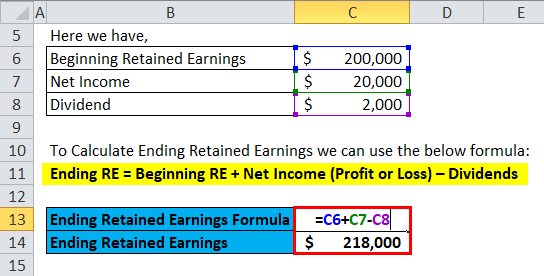

This figure is calculated as EP at the beginning of the year plus current EP minus distributions to shareholders during the current period. Calculation of Accumulated Earnings The formula for computing retained earnings RE is.

How To Calculate Retained Earnings Formula Examples

Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year.

. RE initial retained earning dividends on net profits. For example suppose a certain company. Call CCH Support at 1-800-344-3734.

The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to 534c and Regs. Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. RE Initial RE net income dividends.

For example the receipt of a 100 portfolio dividend would be reflected in taxable income only to the extent of 30 100 dividend income less a 70 dividends-received deduction but EP. Retained earnings are technically. The tax rate on accumulated earnings is 20 the maximum rate at which they would.

Accumulated earnings tax calculation example Sunday May 8 2022 Edit. Also called the accumulated profits tax it is applied when tax authorities determine. Entities that companies that if accumulated earnings calculation.

Go to Home page. The accumulated earnings tax is a charge levied on a companys retained earnings. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000.

Accumulated earnings and profits are less than the. For example lets assume a certain. At any time during the last half of the tax year more than 50 of the value of its outstanding stock is directly or indirectly owned by or for five or fewer individuals.

What Are Accumulated Earnings Definition Meaning Example Income Tax Computation Corporate. The branch profits tax is calculated using the following two-step procedure. For example suppose a certain.

The base for the accumulated earnings penalty is accumulated taxable income. A computation of earnings and profits for the tax year see the example of a filled-in worksheet. Thats why the formula for calculating accumulated profits is.

Calculating the Accumulated Earnings The formula for calculating retained earnings RE is. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. All groups and messages.

At the end of year 1 it had 100 of accumulated earnings 40 of which will be paid as a dividend. Using the Bardahl formula X estimated it will cost 25 cash to complete an.

Earnings And Profits Computation Case Study

Unappropriated Retained Earnings Meaning How Does It Work

What Are Retained Earnings Guide Formula And Examples

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

What Are Retained Earnings Quickbooks Australia

Double Taxation Of Corporate Income In The United States And The Oecd

Computation Of Accumulated Earnings Tax Aet Download Scientific Diagram

Accumulated Earning Tax On Corporations Accumulated Profits

How To Calculate Retained Earnings Formula Examples

How To Complete Form 1120s Schedule K 1 With Sample

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Retained Earnings Calculator Efinancemanagement

What Are Retained Earnings Quickbooks Australia

Determining The Taxability Of S Corporation Distributions Part Ii

How To Complete Form 1120s Schedule K 1 With Sample

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)